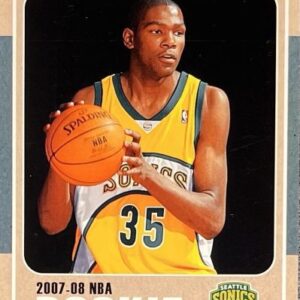

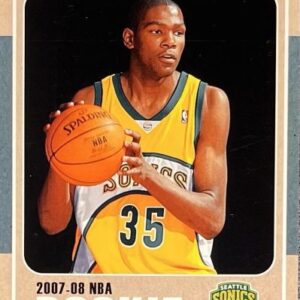

Lloyd Howell’s entry into the helm as the NFL Players Association’s executive director swung open a door that led them straight into a $7 million financial pit. The NFLPA, under Howell’s leadership, now faces the consequences of an arbitration ruling that requires them to fork over $7 million to the trading card powerhouse Panini. The dispute stemmed from the NFL Players Association’s termination of their exclusive trading card contract with Panini last year, triggering a legal battle that ended unfavorably for the NFLPA.

In the heart of this clash lies a tale of allegiance and betrayal—when Panini found themselves deserted following the exodus of their key employees to their competitor, Fanatics, the NFLPA saw an opportunity to turn the tide. Citing a “change in control” clause, the NFLPA sought to sever ties with Panini, citing justifiable reasons for the break-up. However, Panini wasn’t buying it. They argued that the NFLPA’s move was a mere guise to cozy up to Fanatics, and the arbitrators echoed the sentiment, siding with Panini.

Panini’s legal counsel, David Boies, didn’t hold back in his triumphant declaration post-arbitration. He emphasized the arbitrators’ unanimous decision as a vindication of Panini’s stance, labeling the NFLPA’s actions as a breach of legal and moral obligations. Boies highlighted the ripple effects of the NFLPA’s actions, pointing out the monetary damages inflicted on both Panini and, ultimately, the players themselves. Despite the financial blow, Panini upheld its commitment to the fans and collectors by ensuring the continued availability of trading cards, cushioning the impact of the NFLPA’s abrupt termination.

As the dust settles on this arbitration ruling, a new chapter unfolds with Panini’s legal vendetta against Fanatics in the form of an antitrust and tortious interference lawsuit. The NFLPA, on the other hand, remains tight-lipped, offering no comments in response to inquiries. While the legal battles play out in the courtroom, the consequences of this bitter fallout resonate beyond the financial realm for the NFLPA.

The repercussions of this arbitration ruling transcend the mere exchange of funds. It casts a shadow of doubt on the NFLPA’s decision-making strategy and its fidelity to its members, fans, and the larger trading card community. With $7 million on the line, the NFLPA finds itself at a crossroads, faced with the daunting task of rebuilding trust and reaffirming its commitments amidst the aftermath of a costly dispute. The tale of the NFLPA’s clash with Panini serves as a cautionary reminder of the stakes involved in business dealings and the far-reaching consequences of breached contracts in the high-stakes world of sports partnerships.